In Sage 300 ERP, we offer the Tax Deducted at Source add-on, which allows users to deduct TDS with just a few clicks. ‘Nature of Deduction’, ‘Branch code’, ‘Fiscal Year’, ‘Due Date’, and ‘Quarter’, are the details of TDS. Nature of Deduction and Branch code are fetched from D/T party details. Fiscal Year is set in the D/T options screen. The due date and Quarter are calculated according to the Document date.

As the Due date is calculated according to the Document date only we are now coming up with the new provision of calculating the Due date according to the Posting date also. Now the user will have the flexibility of deducting the TDS on the document date as well as the posting date.

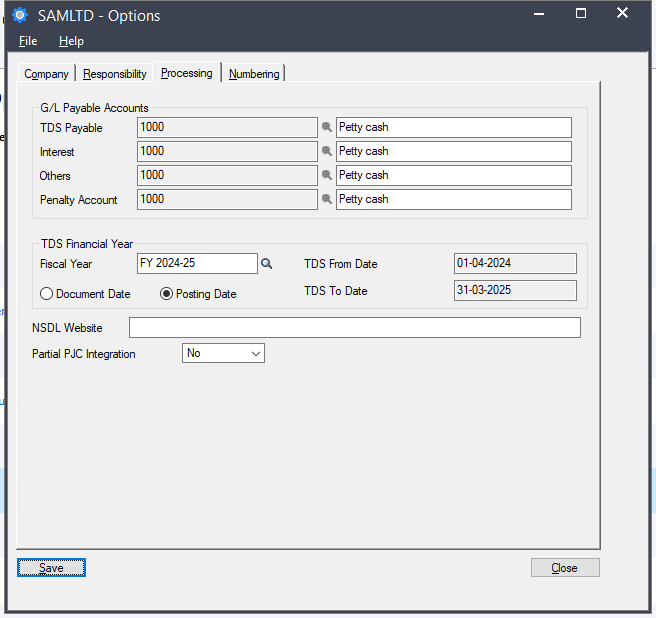

To achieve this, we have provided Document date and Posting date options on the D/T Options Screen.

New Stuff: Sage 300: OE Order Update/Insert API

As you can see in the above image, there is a provision for the user to choose the Document Date and Posting Date by selecting one of them.

If the user wants to calculate TDS based on the document date, they need to select the document date. If the user prefers to calculate TDS based on the posting date, they need to select the posting date.

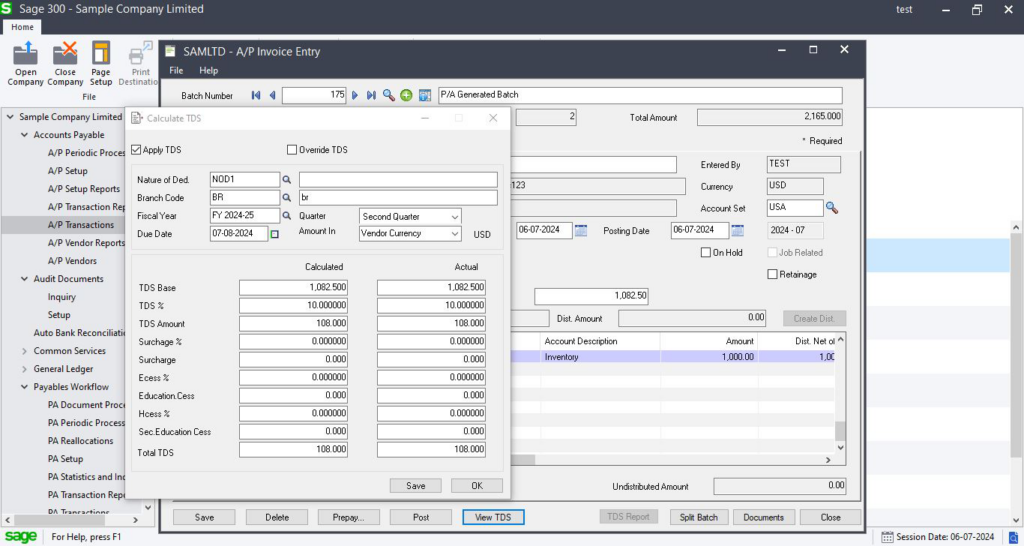

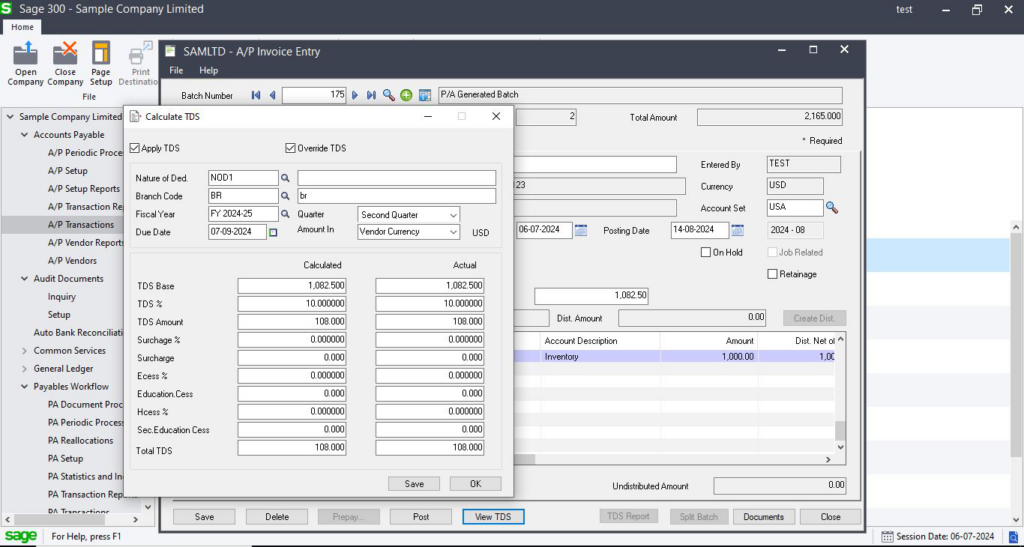

In the above two images, the due date is calculated according to the posting date as we have selected the Posting Date in the D/T Options screen. In the first image, posting date is of July month so the due date is of August month. In the second image, posting date is of August month so the due date is of September month.

By giving the Document/Posting date options to deduct TDS will provide the user a flexibility for different dates.

About Us

Greytrix – a globally recognized and one of the oldest Sage Development Partner is a one-stop solution provider for Sage ERP and Sage CRM organizational needs. Being acknowledged and rewarded for multi-man years of experience, we bring complete end-to-end assistance for your technical consultations, product customizations, data migration, system integrations, third party add-on development and implementation competence.

Greytrix offers unique GUMU integrated solutions of Sage 300 with Sage CRM, Salesforce(listed on Salesforce Appexchange), Dynamics 365 CRM and Magento eCommerce along with Sage 300 Migration from Sage 50 US, Sage 50 CA, Sage PRO, QuickBooks, Sage Business Vision and Sage Business Works. We also offer best-in-class Sage 300 customization and development services and integration services for applications such as POS | WMS | Payroll | Shipping System | Business Intelligence | eCommerce for Sage 300 ERP and for Sage 300c development services we offer, upgrades of older codes and screens to new web screens, latest integrations using Data and web services to Sage business partners, end users and Sage PSG worldwide.

integrated solutions of Sage 300 with Sage CRM, Salesforce(listed on Salesforce Appexchange), Dynamics 365 CRM and Magento eCommerce along with Sage 300 Migration from Sage 50 US, Sage 50 CA, Sage PRO, QuickBooks, Sage Business Vision and Sage Business Works. We also offer best-in-class Sage 300 customization and development services and integration services for applications such as POS | WMS | Payroll | Shipping System | Business Intelligence | eCommerce for Sage 300 ERP and for Sage 300c development services we offer, upgrades of older codes and screens to new web screens, latest integrations using Data and web services to Sage business partners, end users and Sage PSG worldwide.

Greytrix offers 20+ addons for Sage 300 to enhance productivity such as GreyMatrix, Document Attachment, Document Numbering, Auto-Bank Reconciliation, Purchase Approval System, Three way PO matching, Bill of Lading and VAT for Middle East. The GUMU integration for Dynamics 365 CRM – Sage ERP is listed on Microsoft Appsource with easy implementation package.

integration for Dynamics 365 CRM – Sage ERP is listed on Microsoft Appsource with easy implementation package.

The GUMU Cloud framework by Greytrix forms the backbone of cloud integrations that are managed in real-time for processing and execution of application programs at the click of a button.

Cloud framework by Greytrix forms the backbone of cloud integrations that are managed in real-time for processing and execution of application programs at the click of a button.

For more details on Sage 300 and Sage 300c Services, please contact us at accpac@greytrix.com, We will like to hear from you.

The post Due Date calculation based on Posting Date appeared first on Sage 300 ERP – Tips, Tricks and Components.