We often hear the term Sub-Ledgers or Subsidiary Ledgers in accounting transactions or in an ERP Implementation. In this post we will share some knowledge about what are they, why they are used and what all we need to know while using Subsidiary Ledgers.

WHAT are Subsidiary Ledgers?

A subsidiary ledger contains the details of an account to support a general ledger control account.

e.g. Accounts Payable, Accounts Receivable, Inventory Control, etc.

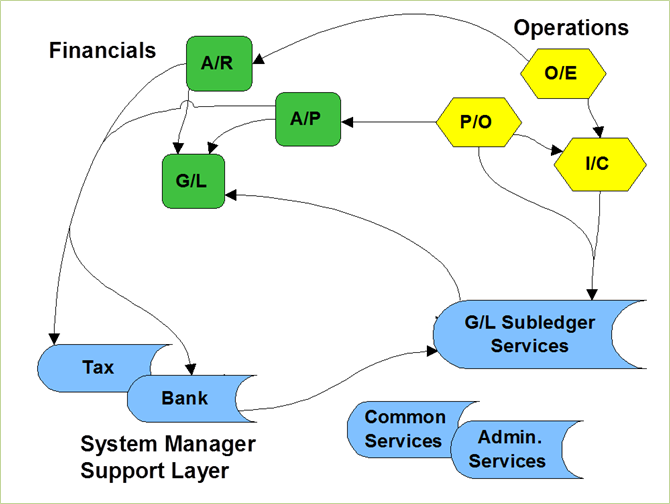

Sage 300 (formerly Accpac) General Ledger and Sub Ledgers Structure

WHY use Subsidiary Ledgers?

>> Significant GL and Detailed Sub ledger

A Balance Sheet or P&L are supposed to provide summary level information about company’s financials while Sub ledgers like AP and AR have to provide detailed information of Expenses and Revenues that accumulate to arrive at this figure.

>>Allows Multiple Accounting Presentations (IFRS, GAAP)

Reporting can be done according to various accounting principles and having a LG and SLA can help maintain this easily.

>>Segregated Authorization and Access Control

Users can be segregated and Access Rights can be given to specific modules preventing post of inadvertent changes to GL or Unauthorized Access.

Sage 300 ERP takes care of Sub ledger accounting with lot many added features and also helps maintain strict access control policies by implementing features like Control Accounts.

DIFFERENCE between Sub ledger and General Ledgers:

The primary difference in the behavior of the general ledger and the sub-ledgers on the system is

>>Sub-ledger balances change based on the date that individual transactions are processed. Sub-ledger reports are snapshots or point in time reports and you must run the reports at the proper time in order to reconcile the reports to the appropriate general ledger control account balances.

>>General ledger balances change strictly based on the period and year that each transaction is posted to.

Things to TAKE CARE of:

>>Avoid Mismatch of Balances:

Have proper checks in place to avoid General Ledger and Sub Ledger mismatch.

>>Make sure to give proper Access Rights:

Take care that you don’t grant access to more or less than what’s required

>>Reporting:

Know which reports will come from Sub ledgers and which ones from General Ledger

Also Read:

1. General Ledger (GL) Accounts Distribution in Sage 300 ERP

2. General Ledger Period End Maintenance

3. How to analyze difference in Sub-ledger and General Ledger in Sage 300 ERP

4. General Ledger Security in Sage 300 ERP

5. Restrict Posting to Inactive G/L Account through Sub-Ledger