Sage 300 ERP provides A/P Terms code feature which allow users to define due date type, Discount type and Discount percent, calculate Base for Discount with Tax, etc.

New Stuff: GL Batch Creation in two databases simultaneously

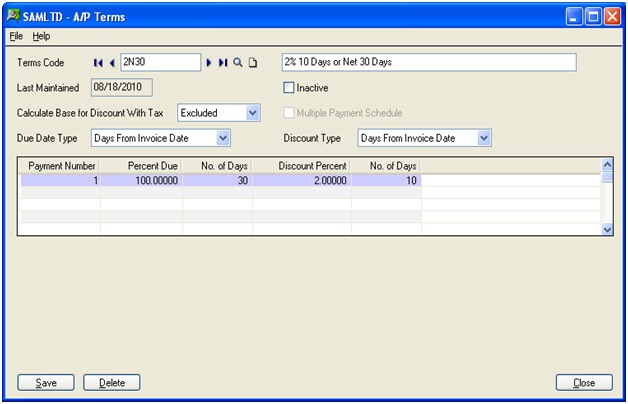

One can access the A/P Terms code screen from the Menu Account Payable >>A/P Setup >>Terms which has been shown in the following screen shot:

Different features of the Terms code screen are as follows:

1. Terms Code: A term code can be defined a maximum up to six digits.

2. Last Maintained: This field displays the date of the last change made to the terms code.

3. Calculate Base for Discount with Tax: This will specify whether the tax amount will be included or excluded in invoice amount while calculating the discount amount.

4. Discount Type: A method needs to be selected for a vendor to calculate the last day on which you may take a discount for prompt payment. You select from the options for Due Date Type, and type discount percentages.

The discount fields and columns should be ignoble in case discounts are not received from your vendors.

a. Days from invoice date:Select this option if discount dates are calculated as a particularnumber of days from the document date.

b. End of next month: Select this option if the discount date is the last day of the next month, regardless of the document date or the number of days in the month.

c. Day of next month: Type the number of the day of the next month which is the desired discount date.

d. Days from day of next month: Type the number of days from a specific day of the next month. Example: If the discount date is 15 days after the first of the month, enter 15 in the Number of Days field and 1 in the Day of Month field.

e. Disc date table: Select this option if your vendors use standard discount dates for invoices entered within specified ranges of days.

Standard due dates are similar to “day of the month due,” except they do not restrict discount periods to a single date. For example, you can use standard discount dates to assign invoices to the 15th or 30th of each month.

You define the standard discount dates used by your vendors with a table that lets you specify a discount date for each of up to four ranges of days on which invoices were issued. You can also assign discount dates that are one or more months later.

5. Due Date Type: For calculating the due dates for the Transactions, this file is used.

a. Days from invoice date: This option is used if invoices are due by a particular number of days from the document date.

b. End of next month: Select this option if invoices are due on the last day of the next month, regardless of the document date or the number of days in the month.

c. Day of next month: Type the number of the day of the next month that is the due date.

d. Days from day of next month: Type the number of days from a specific day of the next month.

e. Due date table: This option is used if you use standard due dates for invoices entered within aspecified ranges of days.

6. Multiple Payment Schedule: Select this option to define a term code that allowsinstallment payments. When you select this option, the terms table expands to accommodate additional payments (otherwise, only a single line is displayed).

In above screen shot we have checked multiple payments schedule by which we can set the number of payments and their respective discount, percent due etc.

7. Payment Number: With multiple payments you can enter as many periods as you want.

8. Percent Due: Enter the percentage of the balance that is due for each payment number. The total amount entered should be equal to 100.

9. Discount Percentage: This field will be used to specify the discount percentage for the particular payment number.

Note: You cannot assign inactive terms code to any Vendor. Also before deleting any terms code record make sure that you have not assigned it to any Vendor.

Hence with terms code you can define due date as well as discount percentage for transaction.

Also Read:

1. Terms Code feature in Account receivable in Sage 300 ERP

2. Customer Credit Limit in Sage 300 ERP

3. Invoice Retention in Sage 300 ERP

4. Fixed Due Date for Invoices in Sage 300 ERP

5. Interest Invoices for Overdue Receivables