In todays blog we will discuss about one more feature worth noticing of Sage 300 ERP i.e. to see how Automatic Tax Calculations can be achieved for A/R transactions.

New Stuff: Cleanup Accounts Using Apply Document Feature in Sage 300 ERP

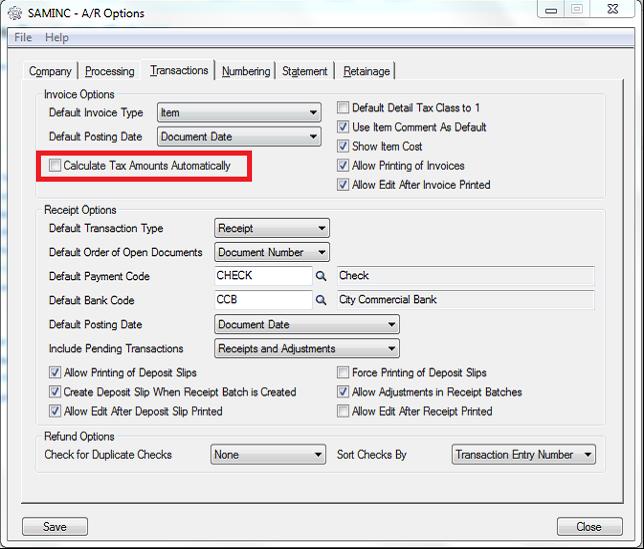

To access this feature you can navigate to Account Receivable >> A/R Setup >> Options >>Transaction Tab

Kindly refer the below screenshot for the same.

1. If User unchecks the option “Calculate Tax Amounts Automatically” in AR Options screen, while creating any A/R Batch transactions taxes will not be calculated by default.

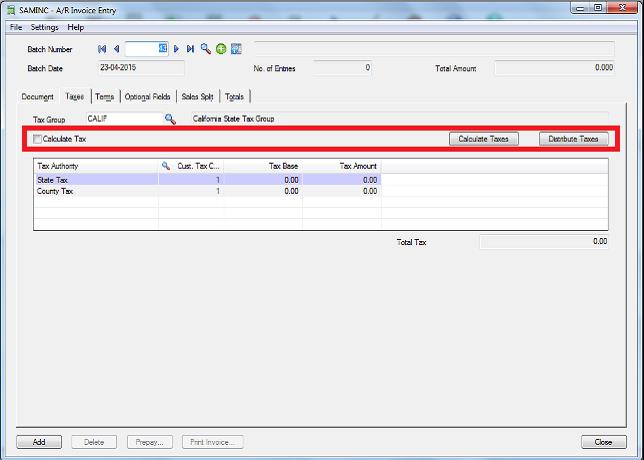

Calculate Tax Check box will be Unchecked in the transaction screen as well as Calculate Taxes and Distribute Taxes button will be displayed for the user to manually calculate the tax. Kindly refer the below screen for the same.

2. If User Checks the option “Calculate Tax Amounts Automatically”; User while trying to create any A/R Batch transactions then taxes will be calculated automatically under Tax tab.

Here by default Calculate Tax checkbox will be checked in the transaction screen. Kindly refer the below screen for the same.

This is how user can set option to calculate taxes automatically in A/R. This setting can be changed any time.

Also Read:

1. Control your AR Receipt editing after being printed

3. Setting up Price Inclusive of Taxes in Sage 300 ERP

4. Tax Calculation on the basis of Quantity in Sage 300 ERP

5. Item wise tax calculation in Sage 300 (for Sales and purchase Transaction)