Sage 300 provides solution to maintain the sales and purchase of goods as per user requirements.

Major part of the Sales and Purchase Transactions is Inventory and Taxation.

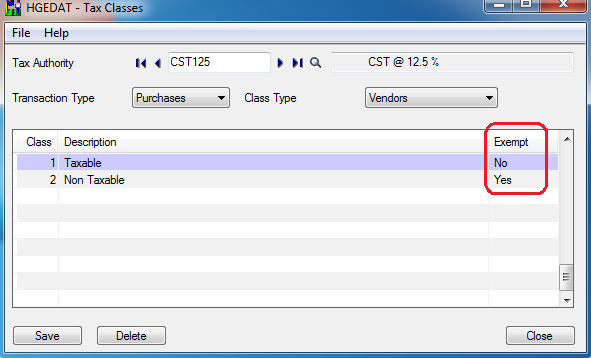

In our previous blog “Taxes” and “Tax Classes in Sage 300 ERP” we had discussed about tax configuration and Tax classes, in this blog we will discuss about one of the feature of Tax Classes i.e. Exempt in detail.

The New Stuff: Tax Tracking Report in Sage 300 ERP

Tax classes are used to define multiple tax classes for sales item, purchase item, customer and vendor.

The following is the path to define the Tax Classes in Sage 300

Path: Common Services >> Tax Services >> Tax Classes

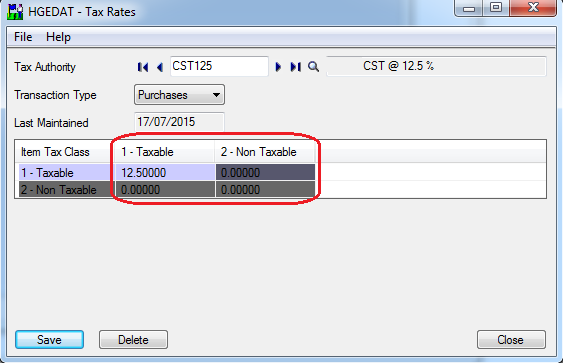

- Exempt functionality is used to allow / deny input of Tax Rate in Tax Rate Master. (Refer the above screen shot.)

After selecting Exempt – Yes. Then in Sage 300, the system will not allow to enter Tax Rate in Tax Rates Master.

(Refer the previous and above screen shot.)

Also Read:

1. Excise Module- Tax Configuration

2. Expense Separately Functionality for Tax in Sage 300 ERP

3. Automatic insertion of Item Wise Detail Tax

4. Subcontracting Process (57F4) in Sage 300 ERP

5. Transfer of Excise duties along with Inventory Transfer in Sage 300 ERP