Greytrix – Tax Deducted at Source (TDS) is based on Indian taxation that helps user to make TDS transactions in just few clicks. To know more, visit our previous blogs on Greytrix TDS.

Considering business scenario where user want to use more than one currency.

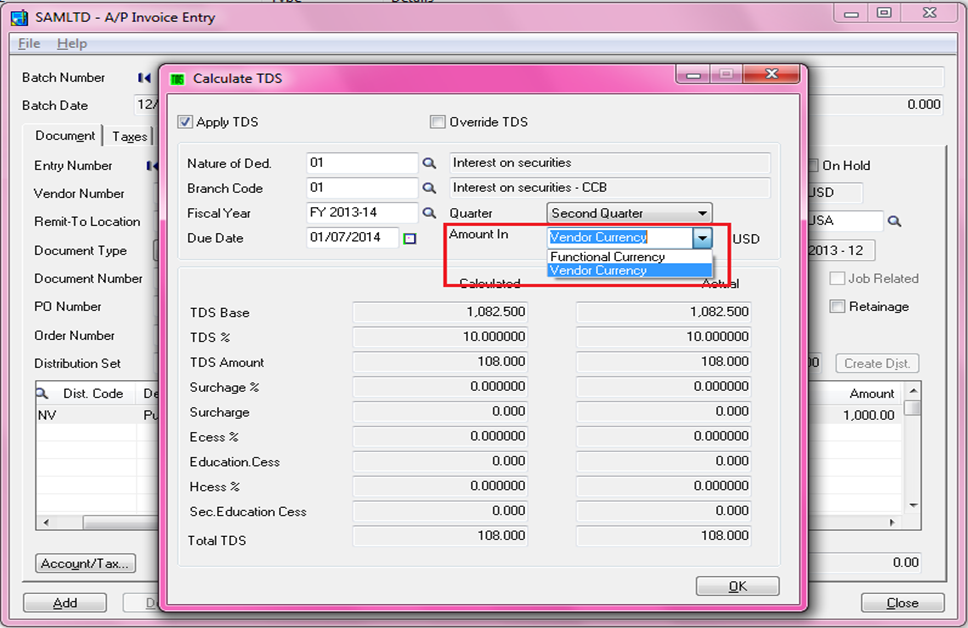

Let’s take an example, there are organizations that do transactions in foreign currency as well as using National currency. Say India uses Indian currency INR, USA uses US Dollars, etc. Here users do not have to check the TDS transaction by converting them into current rate. Greytrix Add-on provides leisure way to check this. On View TDS button click, user can see Amount In as highlighted in below screenshot

Let’s say user wants to deduct TDS on foreign currency vendor using AP Invoice entry.

New Stuff: 3 Way Matching PO Receipt

Note: This functionality works only for multi-currency database

Here user can check both Vendor and Functional currency by selecting Amount In drop down. User does not have to calculate it manually (i.e. Vendor Currency * Rate)

It is available for AP Invoice, Debit Note, Credit Note, Pre-payment, Misc. Payment

Also Read:

1. Greytrix TDS v2.2 for SAGE 300 ERP

2. Configuring Greytrix TDS in Sage 300 ERP – I

3. Configuring Greytrix TDS in Sage 300 ERP – II

4. Configuring Greytrix TDS in Sage 300 ERP – III