In Sage 300 ERP, you can setup prices inclusive of taxes. In this article we will provide guidelines on setting up price inclusive of taxes.

The New Stuff : Multicurrency in Greytrix TDS

First of all you need to setup or identify the tax authority where taxes charged by authority can be included in selling price.

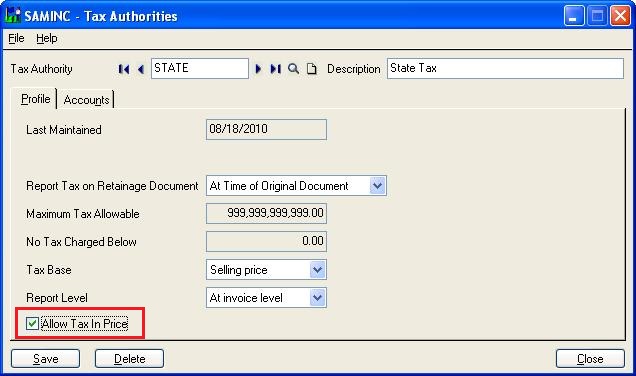

1) In order to configure the Tax Authority to allow tax in price; go to Common Services Module>>Tax Service>>Tax Authorities

2) Select Allow Tax in Price option. In the given example we have configured Authority State for allowing the tax in prices.

Note: Do not select this option if you have customers who are tax exempt, because tax is not extracted from the item price. You would need to adjust the price for the customer.

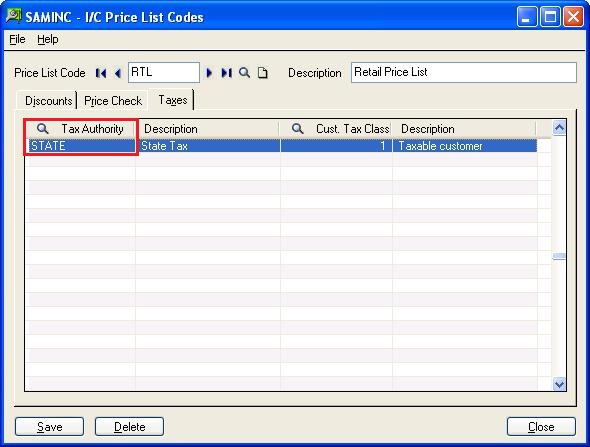

3) Now you need to setup Price Lists and add tax authorities which allow tax in prices.

(Inventory Control>>IC Setup>>Price List code)

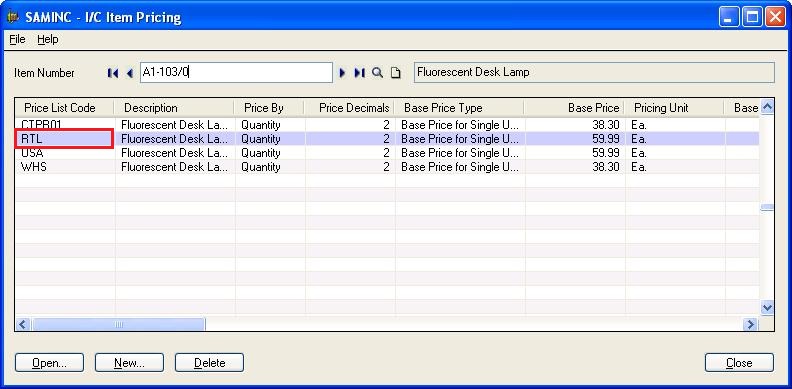

4. Assign the price list to the desired Items.

(Inventory Control>>I/C Items and Price Lists>>Item Pricing)

Now you are able to setup item prices inclusive of taxes.

5. For A/R Items; you need to attach tax authorities which allow tax in prices.

(Accounts Receivable>>A/R Setup>>Items)

Also Read :

1. Tax Calculation on the basis of Quantity in Sage 300 ERP

2. Item Pricing based on Multiple Unit of Measurement

3.Choosing Vendor Contract Cost over IC Vendor Detail Cost in Sage 300 ERP

4. Vendor Pricing Analysis in Sage 300 ERP

5. Create new Items by copying existing items in Sage Accpac ERP