In our last blog we had discussed about why to use Trading Excise. In this blog we will learn how to configure the trading excise module.

Maintaining Company Information

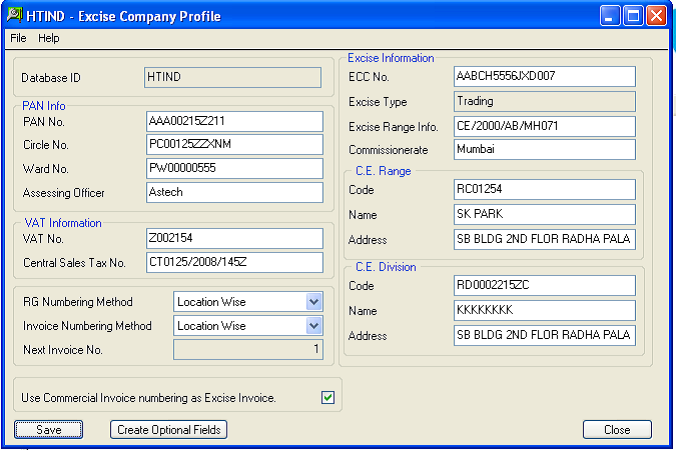

The Central Excise division requires furnishing registration and other statutory information. Excise company profile screen is used to capture the additional information such as ECC NO, PAN No, etc. This information is mandatory as it will reflect in all reports related to this module.

(Go to Manufacturing Excise >> Excise Company profile)

New Stuff: AP Invoice and Payment Voucher -Greytrix extended report pack

Maintaining Location Information

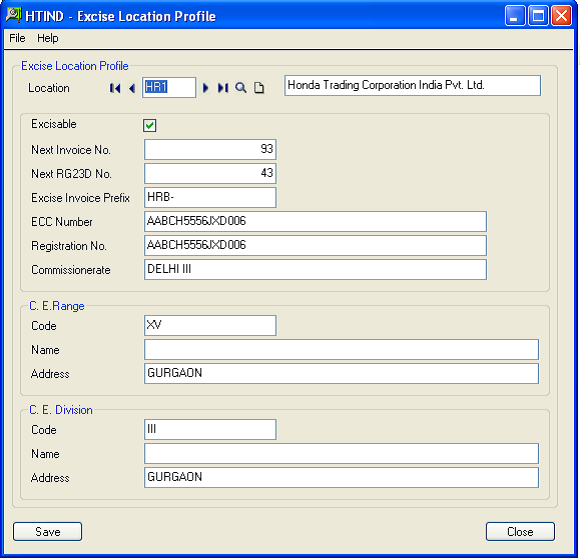

The Excise information is based on Location/Warehouses so in order to have the Excise module function you need to first mark all your location/warehouses as Excisable location. Excise Location Profile is used to capture the additional information such as ECC NO, CE Registration No, etc. This UI will list only locations defined in Sage 300 ERP. To create a new location, the user will need to go to Inventory Module and then come back here to input excise information.

Maintaining Additional Duty Information:

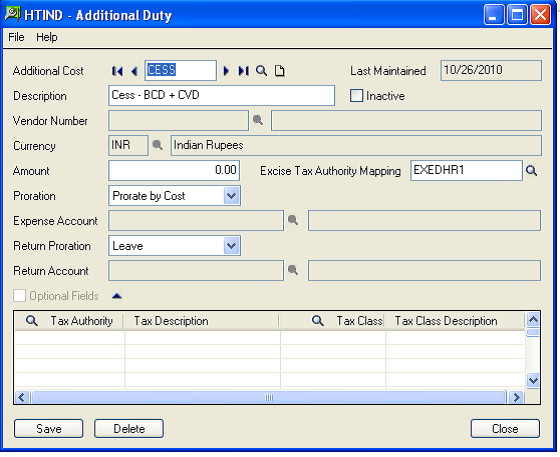

In case of an importer, there are number of Additional duties which need to be passed on. But as Accpac supports only 5 TAX Authorities for a Tax Group, in such case we have tried to use the Additional cost as Additional duties.

We have provided a setup screen to map the additional duties of importer with the Tax authorities. As seen in the below screen shot the Additional cost is mapped to the Tax Authority EXEDHR1, thus when this additional cost is used in the PO Receipt the Tax Amount for Authority EXEDHR1 will be affected with this Amount.

This setting will be useful for the importer’s case.

In this way, we are done with the creation of master data required for Excise module.

In our next blog we will discuss about how to configure the statutory information required for vendor and customers.

Also Read:

1. Taxes in Sage 300 ERP

2. Transfer of Excise duties along with Inventory Transfer in Sage 300 ERP

3. Tax Calculation on the basis of Quantity in Sage 300 ERP