An inventory valuation allows a company to provide a monetary value for items that make up their inventory. Inventories are usually the largest current assets of any business, and proper measurement of them is necessary to assure accurate financial statements. If inventory is not properly measured, expenses and revenues cannot be properly matched and a company could make poor business decisions.

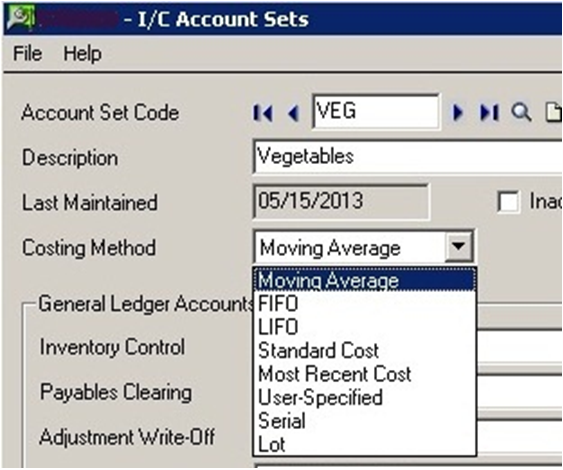

In Sage 300 ERP, there are “8” costing methods defined for inventory valuation. Let’s discuss about all costing methods in detail:

Also Read: Closing Procedure Checklist for Sage 300 ERP

1. FIFO (First In, First Out): In Sage 300 ERP, we will find this costing method in I/C account sets. In this costing method, it is assumed that the individual units of items are consumed in the same sequence as they are purchased. This type of costing can be used in scenarios where item does not lose its value over time with storage and there is regular flow of items in the warehouse.

Note: It is not necessary that the units are actually consumed in the same sequence of their arrival into the system, but for costing purposes it is assumed that the consumption pattern is same as receiving pattern.

Say for an instance; if a Company buys 10 qty. of item “X” for $10/unit cost and then buys 5 more qty. at $15/unit cost. So, by FIFO Method Company would assign $10/unit cost of 10 items at the time of sell. Then would assign $15/unit cost for next 5 items to be sold.

2. Weighted Moving Average Methods: In this method, based on every transaction of the item, cost of item will get updated with the latest cost. Formula used is (Current Quantity * Current Cost + New Quantity * New Cost) / (Current Quantity + New Quantity).

Weighted average cost method overcomes the drawback of FIFO method of not considering inflation in Costing. Weighted average method reflects market cost better than FIFO.

For example; if a Company buys 10 qty. of item “X” for $10/unit cost and then buys 5 more qty. at $15/unit cost. So by average costing method costing will be (10*10+5*15)/ (10+5) = $11.66

3. LIFO (Last In, First Out): LIFO method is not used in India, but is widely used in US and European Countries. This method assumes that the items, which were received last, are consumed first. (This method is not used in Indian accounting system; but this method is widely used in Vegetable market in India, as all consumers want ‘Fresh’ stocks and price of vegetables are updated with the latest cost. Classic LIFO). As can be seen, this method approaches closest to the current cost.

For example, if a Company buys 10 qty. of item “X” for $10/unit cost. Then buys 5 more qty. at $15/unit cost. So by LIFO Method Company would assign $15/unit cost of 5 items at the time of sell. Then would assign $10/unit cost of 10 items in next sell.

4. Standard Costing: In Sage 300 ERP, Standard Cost is the simplest inventory valuation method. In this method, cost is determined by value assigned for the item in the Standard Cost field in Item Maintenance Main tab. Standard cost does not change unless you manually enter a new cost for the item.

The total inventory value of each item equals the quantity on hand multiplied by the standard cost. As items are sold, standard cost is used to determine the cost of goods sold. This method is appropriate only if the standard cost for each item does not change frequently.

Disadvantage of Standard Costing: It does not consider the ‘actual’ costing and hence if the revision in Standard cost in system is not done on regular basis the variance between Actual and Standard/system cost can be high and can result in misleading data in system.

5. Most Recent Cost: In Sage 300 ERP, this costing method is determined by the recent cost for that item. Inventory will update with most recent cost at the time of purchase.

For example, if a item “X” is purchased for $10/ unit; first time inventory will update $10 Cost for that item, if that same item is purchased second time at $12, then inventory will update with $12 for that item from the logic of most recent costing method.

6. Lot number method: In Sage 300 ERP, if you have procured Serial and Lot tracking module you will see this option in IC accountàcosting method option

Items can be grouped and identified by lots for costing and tracking purposes. Lot Number method is appropriate for items that must be identified in groups of units and is often used by food, drug, and chemical manufacturers or distributors. The quantity and cost associated with each lot is retained for each item.

In addition, a lot identification number must be used whenever units received or issued (sold) out of inventory. If more than one lot is involved in a receipt or issue, each lot number and quantity of the transaction must be entered. Because lot number is specified when units are sold, the cost of goods sold matches exactly the purchase cost of the items in the lot.

7. Serial Method: In Sage 300 ERP, if you have procured Serial and Lot tracking module you will see this option in IC accountàcosting method option

The Serial Number method allows you to identify each item with a unique serial number, and retain purchase cost of each item separately. This is often required for large-ticket items such as appliances, computers, furniture, and stereo equipment. Because serial number is specified when units are sold, the cost of goods sold matches exactly the purchase cost of the items in the lot.

8. User Specified costing method: – In Sage 300 ERP, this costing method is generally used for non-stock items but can be used for stock items too. With User Specified Costing, we have to enter unit costs at the time of shipping. While using this costing method, you have to define cost on every transaction.

Hence, depending on the costing method, financial management team can choose preferred costing method. The costing methodology employed can cause significant variations in your financial results. The organization should identify how its inventories are utilized and match this movement with the method that best mirrors its flow.

Related Posts:

1. Profit Margin Analysis in Sage 300 ERP

2. Project Invoicing Feature in Sage 300 ERP

3. Create Jobs related Sales Orders in Sage 300 ERP